College Athletics Embrace Professional Sports Models for Revenue Growth

The college sports landscape is undergoing a seismic shift, driven not by on-field performance alone, but by a complex interplay of escalating coaching salaries, evolving revenue streams, and the relentless pursuit of competitive advantage. This conversation reveals how the traditional model of college athletics is being fundamentally reshaped, exposing hidden consequences for universities, boosters, and athletes alike. Those who grasp the systemic implications--particularly the downstream effects of NIL and the strategic deployment of capital--will gain a significant edge in navigating this new era. This analysis is crucial for athletic directors, university presidents, sports marketers, and investors looking to understand the true cost and potential of modern college sports.

The Escalating Arms Race: Coaching Salaries as a Strategic Investment

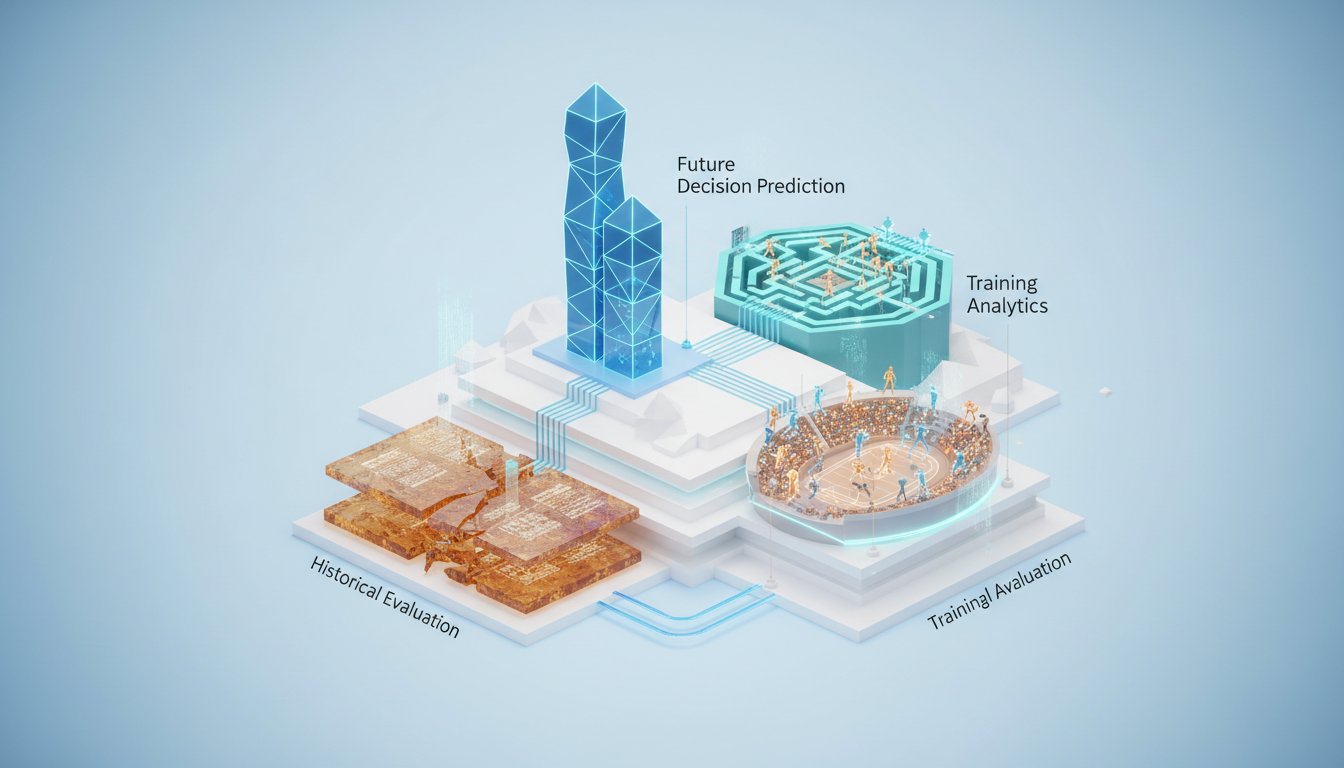

The staggering sums paid to college football coaches like Indiana's Curt Cignetti ($11.6 million annually) and Miami's Mario Cristobal (over $8 million annually) are not mere expenditures; they represent a strategic investment in program turnaround. As Janet Lorin details, these high-profile hires are directly linked to tangible results, such as Indiana's national championship run. This success, in turn, unlocks new revenue streams, as exemplified by the $50 million naming rights deal with Merchants Bank, secured only after the team’s improved performance. This illustrates a critical feedback loop: invest heavily in coaching, achieve on-field success, generate new revenue, and then reinvest.

The implication here is that coaching salaries have transformed from operational costs into potent catalysts for financial growth. Conventional wisdom might see these figures as exorbitant, but from a systems perspective, they are designed to trigger a cascade of positive financial outcomes. The donor’s sentiment, "for the coach, with what he's done, I don't know if you could pay him enough," underscores this shift. It’s no longer about simply paying for wins, but about paying for the entire ecosystem of revenue generation that winning enables--stadium fills, concessions, sponsorships, and crucially, the ability to attract further investment.

"With what he's done, I don't know if you could pay him enough."

-- Michael Petri, Chairman of Merchants Bank

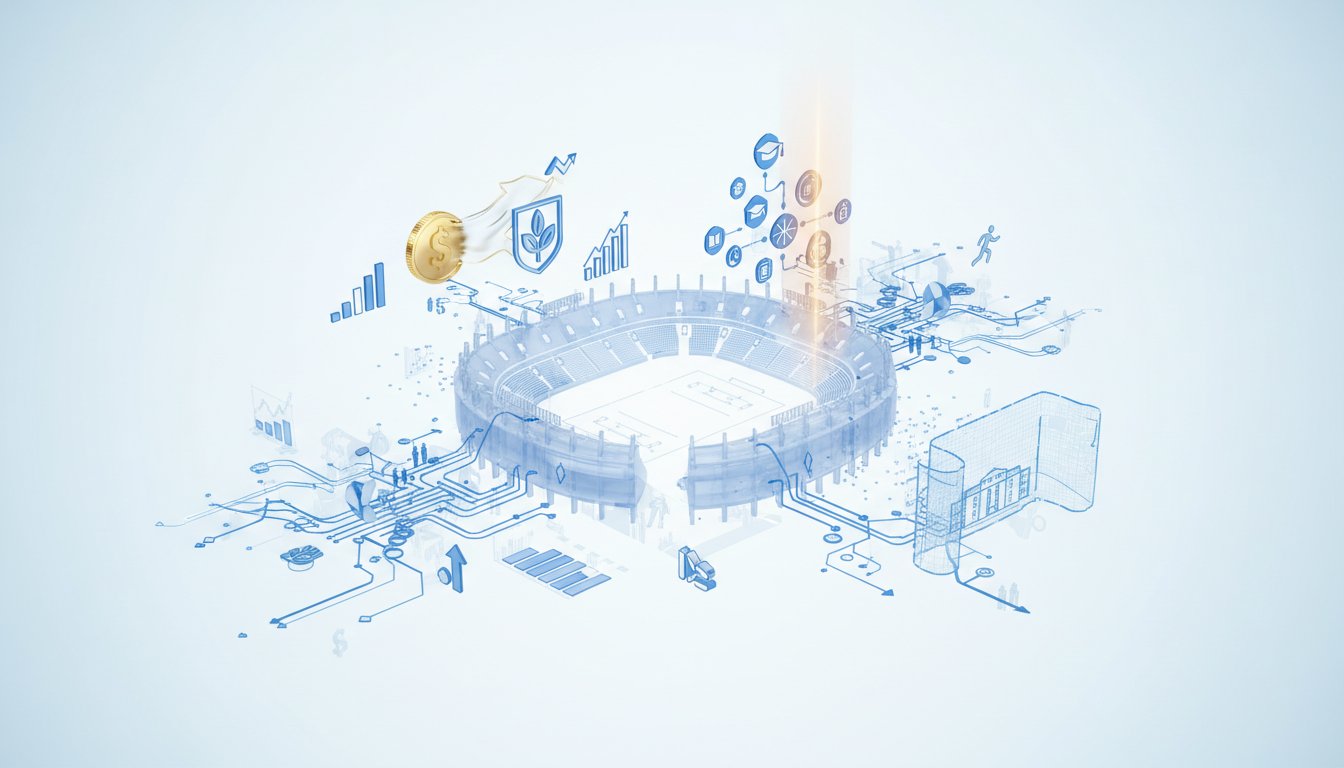

The Uncharted Territory of NIL and Diversified Revenue

The advent of Name, Image, and Likeness (NIL) has fundamentally altered the financial dynamics of college sports, creating a new cost structure that necessitates innovative revenue generation. Lorin highlights how universities are now actively hunting for new income streams, moving beyond traditional ticket and merchandise sales. The normalization of alcohol sales in stadiums, once a rarity, and the hosting of large-scale concerts in massive venues like Michigan's "Big House" (which sold over 112,000 tickets) are prime examples of this diversification. These initiatives mirror the revenue models of professional sports, where stadiums are designed for multi-purpose use to maximize profitability.

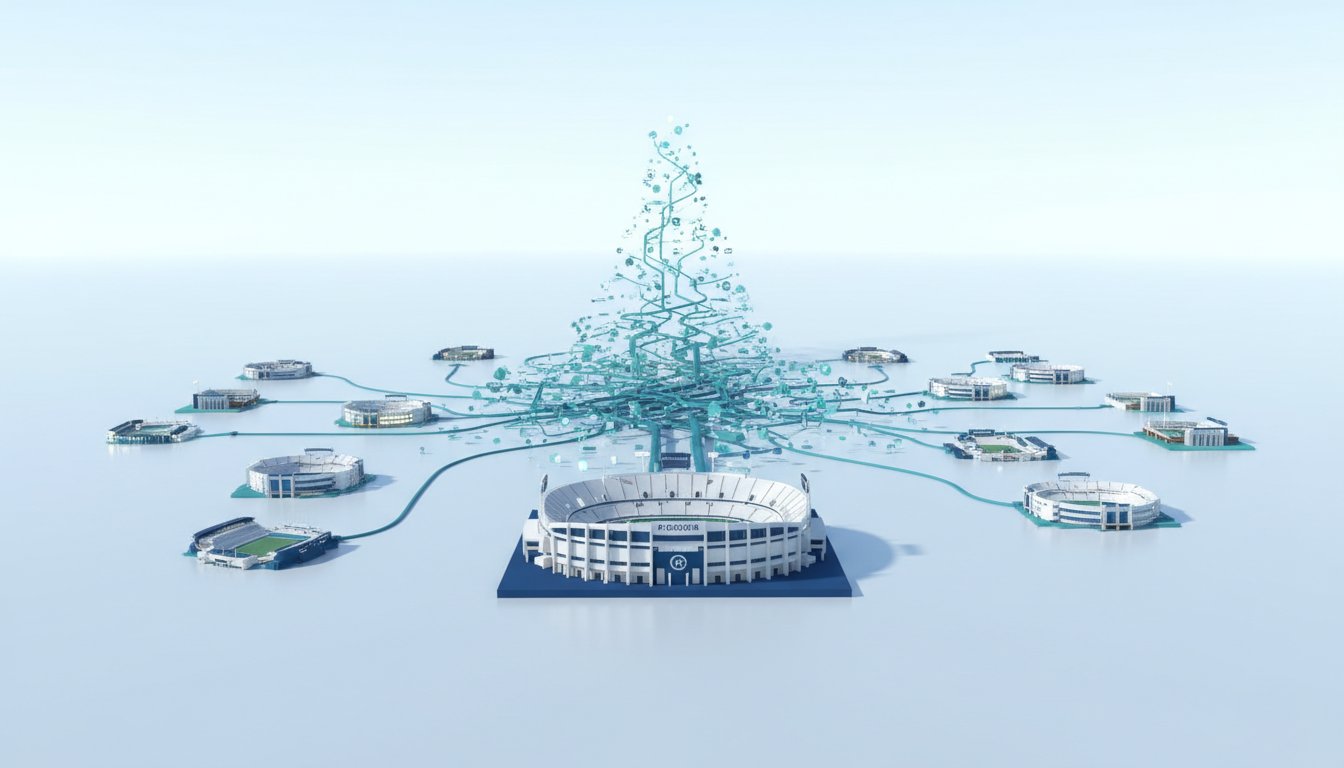

This pivot is not merely about increasing revenue; it's about adapting to a new reality where significant funds are now directed towards players. The $20.5 million annual cap for NIL deals, set to increase by 4%, represents a massive financial commitment. Universities must therefore find ways to offset these costs, leading them to explore every available asset--their stadiums, their brand, and even their athletic events as entertainment platforms. This creates a complex system where on-field success is directly tied to financial viability, and financial viability requires a sophisticated approach to revenue diversification that extends far beyond the game itself. The analogy here is that universities are no longer just sports teams; they are becoming entertainment conglomerates, leveraging their physical assets and fan engagement to compete in a new financial arena.

"We need to find ways to get money. We have these massive stadiums, and they sit empty except for eight to ten times a year. We're going to do more events there."

-- Janet Lorin

The "No Bull" Mentality: Building Brands on Grit and Holistic Growth

Mike Repole’s journey from co-founding Vitaminwater and Body Armor to his current venture with NOBULL offers a masterclass in brand building, emphasizing a philosophy that transcends mere product. Repole stresses that success is not "self-made" but "self-made by others," highlighting the critical importance of team chemistry, diverse skill sets, and shared vision. His relentless work ethic--working 20-hour days, seven days a week--is presented not as a sacrifice, but as a fundamental requirement for achieving ambitious goals. This echoes the ethos of elite athletes like Kobe Bryant and Tom Brady, with whom he has partnered.

NOBULL’s ambition to be a "360 brand" for the "today's athlete" encapsulates this holistic approach. It’s not just about apparel or nutrition, but about the emotional, mental, and physical aspects of an individual’s life. Repole contrasts this with established brands like Nike, suggesting they have "lost their way" by focusing too narrowly on athleisure or style. NOBULL aims to be more than a product provider; it seeks to be a "life coach," inspiring people to "aspire to be better" in all facets of their lives. This requires a "tough love brand" approach, one that is "real, genuine, and authentic." The delayed payoff here is the creation of deep brand loyalty rooted in shared values and a commitment to continuous self-improvement, a moat that competitors focused solely on product may struggle to replicate.

"No Bull wants to be that 360 brand for you, for today's athlete. You know, the emotional part, the mental part, the physical part. It's not just about the gym, it's not just about running, it's not just about walking. It's about the mentality piece..."

-- Mike Repole

Key Action Items

-

Immediate Actions (Next 3-6 Months):

- Athletic Departments: Conduct a comprehensive audit of existing stadium and venue usage to identify underutilized assets for potential revenue-generating events (concerts, other sporting events).

- Coaches & ADs: Develop a clear ROI framework for coaching salaries, demonstrating how investments in top talent directly correlate with projected revenue increases from sponsorships, ticket sales, and donor contributions.

- Brands (e.g., NOBULL): Pilot integrated marketing campaigns that explicitly link physical, mental, and emotional well-being, moving beyond single-product promotion.

- Investors: Analyze college athletic department financial statements with a focus on diversified revenue streams beyond traditional sports income.

-

Longer-Term Investments (6-18 Months+):

- Universities: Establish dedicated teams or departments focused on non-traditional revenue generation for athletics, similar to professional sports entertainment divisions.

- Brands: Invest in building community platforms (digital or physical) that foster the "No Bull" mentality, encouraging holistic personal development beyond product consumption. This creates a sticky customer base.

- Athletic Departments & Conferences: Explore strategic partnerships with private equity or venture capital firms, specifically those with a clear understanding of the long-term, multifaceted revenue potential in college sports, not just short-term exits.

- Coaches: Focus on building program culture that emphasizes resilience and continuous improvement, creating a durable competitive advantage that transcends individual player recruitment cycles. This requires investing in player development beyond just on-field skills.