Systemic Fraud in Welfare Programs Erodes Trust and Prompts Radical Tax Proposals

TL;DR

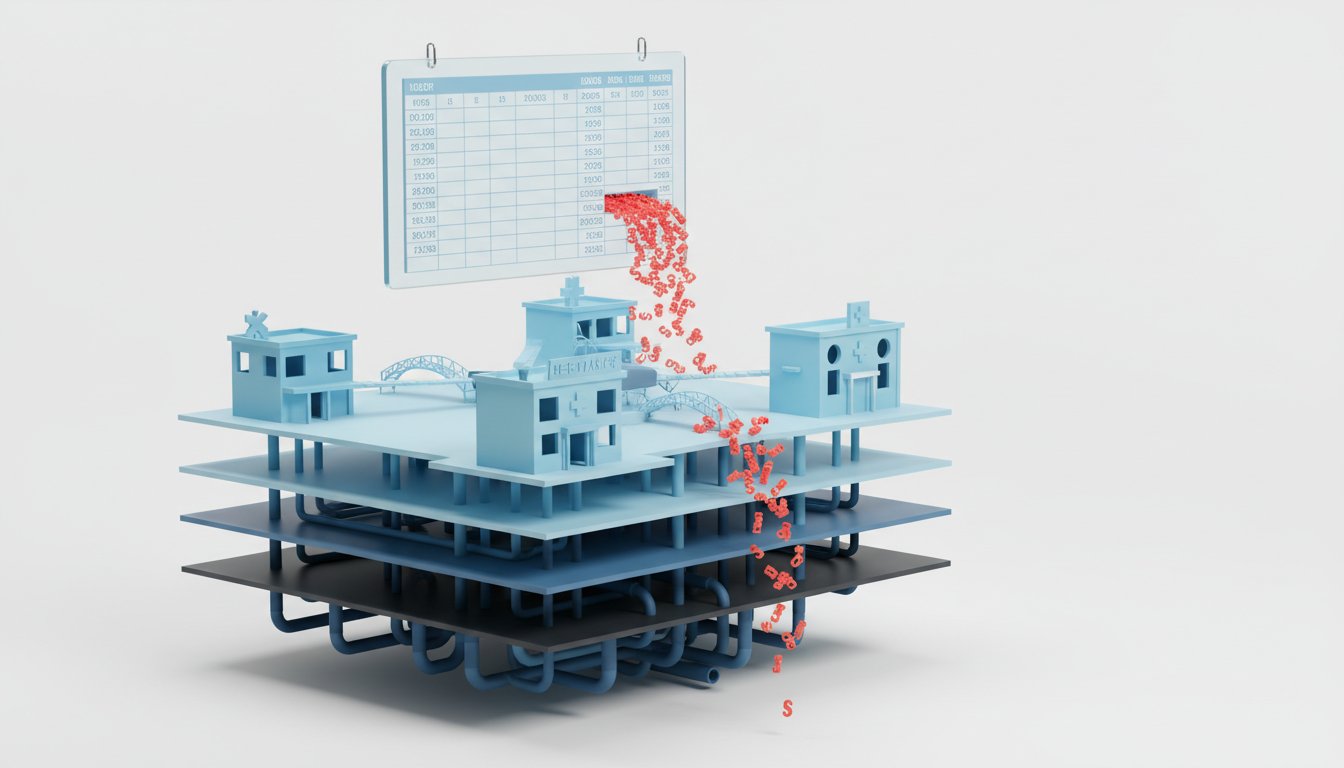

- Massive entitlement fraud, exceeding $9 billion in Minnesota since 2018, operates at an "industrial scale" by exploiting welfare programs like childcare and Medicaid, indicating systemic failures in oversight and enforcement.

- Investigative journalist Nick Shirley's independent reporting, characterized by on-the-ground evidence gathering, has brought national attention to large-scale fraud that mainstream media initially avoided, highlighting the power of citizen journalism.

- The Minnesota fraud scheme involves entities receiving millions in public subsidies for non-operational daycares, suggesting a patronage system where political support is exchanged for turning a blind eye to widespread theft.

- California's proposed "Billionaire Tax" represents a fundamental shift towards taxing private property as a mechanism to fund state shortfalls, setting a dangerous precedent for asset seizure beyond income-based taxation.

- The potential for widespread fraud in government programs, estimated by some to be 20% of federal spending, poses a significant risk to the U.S. economy, potentially leading to bond market instability and fiscal collapse.

- The normalization of fraud and waste in government spending, fueled by political patronage and a lack of accountability, is eroding public trust and hindering the country's ability to address critical issues like healthcare and infrastructure.

- The AI industry's innovation, particularly in optimizing the "decode" phase of model generation, offers a path to making AI more accessible and affordable, potentially accelerating application development and broader adoption.

Deep Dive

Investigative journalist Nick Shirley's viral video exposing significant fraud in Minnesota's childcare assistance program highlights a systemic breakdown in government oversight and accountability. This exposé, detailing potentially over $110 million in fraudulent claims, reveals a pattern of industrial-scale entitlement fraud that has persisted for over a decade, involving billions in misallocated public funds. The implications extend beyond mere financial loss, suggesting a patronage system where political considerations may be paralyzing enforcement, potentially fueling further corruption and impacting national discourse on immigration, welfare programs, and government efficiency.

The mechanics of the fraud, as demonstrated by Shirley's on-the-ground investigation, involve the creation of shell organizations, often disguised as childcare centers or healthcare clinics, which receive millions in public subsidies based on fabricated enrollments. These entities frequently exhibit clear signs of non-operation, such as blacked-out windows and locked doors, yet continue to receive funding. This raises critical questions about the efficacy of state and federal oversight mechanisms, which appear to be failing to identify and halt these schemes. The scale of the problem is underscored by federal prosecutors describing it as "staggering" and "industrial scale," with numerous convictions for hundreds of millions in fraud since 2022 alone, often involving a specific ethnic community, which has complicated public and media response.

The broader second-order implications are profound. Shirley's work, independently funded and disseminated, bypasses traditional media gatekeepers, demonstrating a new model for investigative journalism that can rapidly achieve national reach. This challenges established media outlets, some of which have been criticized for their delayed or insufficient coverage despite the story's decade-long presence in local news. The narrative also touches upon the potential for such fraud to be linked to the funding of international terrorist organizations, a claim that, if substantiated, would elevate the stakes dramatically and necessitate a coordinated, multi-agency federal response. Furthermore, the discussion reveals a potential patronage system at play, where politicians may overlook or enable such fraud in exchange for votes and campaign support from organized community groups. This suggests that the issue is not merely isolated malfeasance but a deeply embedded political dynamic that leverages welfare programs for electoral gain. The potential for this pattern to be replicated in other states, as hinted by observations in Ohio and Washington, indicates that this is not a localized problem but a national vulnerability.

The proposed billionaire's tax in California, discussed in parallel, serves as a stark indicator of the public's growing frustration with perceived government inefficiency and the scale of financial mismanagement. While framed as a solution to fund essential services like healthcare, the proposed tax on private property assets, rather than realized income, represents a fundamental shift in taxation principles with potentially far-reaching consequences. Critics argue that such taxes have historically failed to generate sustainable revenue, leading to capital flight and ultimately reducing overall tax intake. More critically, the push for such measures reflects a deeper societal anxiety about economic inequality, the rising cost of living, and the perceived inability of government to effectively manage its existing resources. The fear that government overreach in taxation could erode private property rights, coupled with the demonstrated failures in program oversight, creates a volatile environment where public trust is eroded, and extreme policy proposals gain traction. The overarching takeaway is that systemic failures in government accountability and fiscal management, as exemplified by the Minnesota fraud case, create fertile ground for both widespread public discontent and the normalization of more radical policy interventions, with significant implications for the future of American governance and its economic stability.

Action Items

- Audit Minnesota child care assistance program: Identify 5-10 specific control weaknesses that enable large-scale fraud and propose systemic improvements to prevent future abuse.

- Draft runbook template: Define 5 required sections (e.g., setup, common failures, rollback, monitoring) for government programs to prevent knowledge silos and ensure operational continuity.

- Analyze California's wealth tax proposal: Quantify the potential impact on asset flight and overall tax revenue, comparing it to historical outcomes in France.

- Track federal entitlement program spending: Identify 3-5 programs with the highest reported improper payments and assess the root causes of financial leakage.

- Measure correlation between government funding and program outcomes: For 2-3 programs, calculate the relationship between disbursed funds and stated objectives to identify inefficiencies.

Key Quotes

"the magnitude cannot be overstated it's staggering industrial scale fraud there have been over 90 convictions for more than 800 million in fraud since 2022"

This quote from a federal prosecutor highlights the immense scale of fraud in Minnesota. The phrase "industrial scale" suggests a systematic and organized nature to the fraudulent activities, implying a level of sophistication beyond isolated incidents. The mention of over 90 convictions for more than $800 million since 2022 underscores the ongoing and significant financial impact of this fraud.

"massive welfare fraud is being committed people are opening up these daycares home healthcare clinics you name it anything that has anything to do with like welfare or even just like helping people in general like with daycare or with healthcare they're opening up these companies and then they're able to receive millions of dollars"

Investigative journalist Nick Shirley explains the mechanics of the fraud by detailing how individuals establish entities like daycares and healthcare clinics. Shirley points out that these businesses are designed to access welfare programs and receive substantial funding. This quote illustrates the broad scope of the fraudulent schemes, targeting various social assistance programs.

"the allegation has come out oh you went on a saturday oh you went during christmas and i guess you could address that because now people are obviously vetting your journalism well it's on i went on december 16th which is a weekday before christmas break so there's that and then um sorry the question as far as like did i do the vetting and whatnot the man who helped me like lead the investigation himself david he had all the paperwork from the capital he had somebody from inside the capital leaking him the information so there was my like fact check per se was he had a source from inside the capital that's how we were able to get the numbers specifically"

Nick Shirley addresses skepticism about his journalistic methods by explaining his vetting process. Shirley clarifies that his investigation included corroboration from an insider source within the capital who provided official paperwork. This quote demonstrates Shirley's commitment to substantiating his findings, even when facing scrutiny regarding the timing and methodology of his reporting.

"the story's gone viral because it includes so many aspects of dysfunction i mean you've got the issue of illegal immigrants some of the people in the somali community got here legally some of them didn't you then have these progressive judges who foolishly voided convictions of some of the fraudsters who were doing this i mean it's just classic example suicidal empathy or something like that so you have that aspect of the story and then you've got the political corruption again these are not isolated incidents this is a case where i think we have to see this as a system at work not just an example of like a few isolated fraudsters"

David Sacks analyzes why the fraud story has gained significant traction. Sacks argues that the story's virality stems from its intersection of multiple societal issues, including immigration, judicial leniency, and political corruption. He emphasizes that the fraud is not merely a collection of isolated incidents but rather indicative of a systemic problem.

"for the first time ever we are talking about placing a tax on people's private property that hasn't turned into cash for example you own some real estate you own an apartment building well i think it's worse than that i think it's worse than that because a lot of people are calling this an unrealized gains tax but it's not an unrealized gains tax you could have realized let's say let's say that you just had a big outcome and you sold your stock and you made a billion dollars you were fully paid up on all of your taxes"

Chamath Palihapitiya explains the fundamental nature of the proposed billionaire tax. Palihapitiya clarifies that this tax would target private property, even if it has not been converted into cash and has already been taxed upon realization. He distinguishes this from traditional income taxes, framing it as a potential seizure of assets.

"the real goal of this just just so everyone understands the real goal of this is not to tax billionaires because there are other ways to tax billionaires the real goal of this is to create for the first time in american history a private property asset seizure tax and to use that as a way to take a percentage because they're going after the 100 they're going after the 170 trillion not the 8 trillion at the billionaires normalizing auditing every american to understand what they own and then take a percentage of it every year"

Chamath Palihapitiya further elaborates on the underlying objective of the proposed billionaire tax. Palihapitiya asserts that the true aim is not simply to tax billionaires but to establish a precedent for a private property asset seizure tax. He suggests this is a mechanism to access a much larger pool of wealth beyond that of billionaires, potentially impacting all Americans.

Resources

External Resources

Books

- "The Art of War" by Sun Tzu - Mentioned as a foundational text for strategic thinking.

Articles & Papers

- "The Art of War" (Sun Tzu) - Mentioned as a foundational text for strategic thinking.

People

- Nick Shirley - Investigative journalist who uncovered potential fraud in Minnesota.

- Jeff Bailon - Investigative reporter who launched an initial investigation into entitlement fraud in Minnesota in 2013.

- Cash Patel - Mentioned in relation to responses to fraud investigations.

- Christine Nome - DHS Secretary, mentioned in relation to responses to fraud investigations.

- David - Individual who conducted his own investigation into childcare centers and funding.

- James O'Keefe - Mentioned as an example of an investigative journalist who works with lawyers.

- Tim Walz - Governor of Minnesota, mentioned in relation to the state flag and accusations of pandering.

- Keith Ellison - Attorney General of Minnesota, mentioned regarding the political organization of the Somali community.

- Bessin - Mentioned as having discussed the funding of terrorism on national television.

- Elon Musk - Mentioned as having been proven correct regarding entitlement fraud and as an inspiration for investigative journalism.

- Gavin Newsom - Governor of California, mentioned in relation to the state's fiscal condition and potential for federal bailouts.

- Josh Shapiro - Mentioned as a potential Democratic politician who could adopt a platform of fiscal responsibility.

- J.B. Pritzker - Mentioned as a potential Democratic politician who could adopt a platform of fiscal responsibility.

- Stacy Abrams - Mentioned in relation to the creation of an NGO that received significant funding.

- Rob O'Connor - Mentioned in relation to the potential revenue from taxing billionaires.

- Ro Khanna - Mentioned in relation to the proposed billionaire's tax and its framing.

- Daniel (Spotify CEO) - Mentioned for his work in 3D scanning and its potential impact on healthcare.

- Jonathan (Grok co-founder) - Mentioned as a co-founder of Grok with a visionary approach to AI chip architecture.

- Sunny Madra - Mentioned as president of Grok, bringing practical go-to-market technology experience.

- Gavin Baker - Mentioned for an excellent tweet that broke down "pre-fill" and "decode" in AI models.

- Jenssen (Nvidia CEO) - Mentioned for his insight into the AI industry and his role in the Nvidia-Grok partnership.

Organizations & Institutions

- Fox 9 News - Local news source that covered entitlement fraud in Minnesota.

- DHS - Department of Homeland Security, mentioned in relation to agents inspecting facilities.

- NFL (National Football League) - Mentioned in relation to sports analytics.

- Pro Football Focus (PFF) - Data source for player grading, mentioned in relation to sports analytics.

- SEIU - A union that proposed the billionaire's tax act in California.

- New York Times - Mentioned as having covered the Minnesota fraud story.

- CNN - Mentioned as not having covered the Minnesota fraud story.

- 60 Minutes - Mentioned as an example of traditional investigative journalism with segmented pieces.

- CBS - Mentioned as an example of traditional investigative journalism with segmented pieces.

- The Catholic Church - Mentioned in relation to investigative journalism (Spotlight).

- Big Tobacco - Mentioned in relation to investigative journalism (60 Minutes).

- US Government - Mentioned in relation to funding entitlement programs and potential fraud.

- Federal Reserve - Mentioned in relation to potential bailouts for states.

- TSA - Transportation Security Administration, mentioned in relation to cash smuggling.

- Al Shabaab - Terrorist group, mentioned in relation to potential funding from social programs.

- The Church of Jesus Christ of Latter-day Saints - Mentioned in relation to Nick Shirley's upbringing and morals.

- United Health - Mentioned in relation to healthcare costs.

- Spotify - Mentioned in relation to Daniel's work in 3D scanning for healthcare.

- Function Health - Mentioned as a company working on self-directed healthcare.

- Google - Mentioned in relation to its pioneering of AI technology stacks.

- Nvidia - Mentioned in relation to its GPUs and a licensing agreement with Grok.

- Grok - AI company that entered into a licensing agreement with Nvidia.

- Salesforce - Acquired Slack.

- Definitive - Acquired by Grok.

Websites & Online Resources

- X (formerly Twitter) - Platform where Nick Shirley has his tip section open for donations.

- YouTube - Platform where Nick Shirley posts his videos and earns money.

- Polymarket - Platform where bets are placed on political outcomes, including charges related to Minnesota daycare fraud.

Other Resources

- C CAP funding (Minnesota Child Care Assistance Program) - Tax-exempt funding for childcare subsidies.

- Entitlement fraud - Fraudulent claims made against government entitlement programs.

- Feeding Our Future - A $250 million fraud scheme in Minnesota.

- Autism funds - Funds intended for children with autism that were allegedly stolen.

- Medicaid funds - Funds meant to help people with disabilities that were allegedly stolen.

- Tax-exempt money - Money that is not subject to taxation, mentioned in relation to C CAP funding.

- Voter fraud - Allegations of fraudulent voting practices.

- Whistleblower laws - Laws that reward individuals for reporting fraud.

- Quitam - A framework that allows individuals to sue on behalf of the state and taxpayers.

- Homeless industrial complex - A term used to describe the system of programs and funding for homelessness.

- Billionaire's Tax Act - A proposed tax on individuals with a net worth over a billion dollars in California.

- Direct democratic ballot process - A process in California that allows citizens to vote directly on issues.

- Wealth tax - A tax on an individual's net worth.

- Unrealized gains tax - A tax on the increase in value of an asset that has not yet been sold.

- Capital gains tax - A tax on the profit from the sale of an asset.

- Private property seizure tax - A tax on an individual's assets, even if they have not been converted to cash.

- Asset seizure - The act of taking possession of assets.

- Universal healthcare - A healthcare system where all citizens have access to healthcare.

- Obamacare - The Affordable Care Act, mentioned in relation to healthcare costs and gross margin caps.

- Pre-fill - The initial phase in AI models where the prompt is read and processed.

- Decode - The phase in AI models where a response is generated token by token.

- LLMs (Large Language Models) - AI models that process and generate text.

- AI (Artificial Intelligence) - Mentioned in relation to Grok's technology and future developments.

- Inference chips - Computer chips used for running AI models.

- TPU (Tensor Processing Unit) - Google's custom ASIC chip for neural network machine learning.

- SRAM (Static Random-Access Memory) - A type of semiconductor memory used in electronics.

- V2 chip, V3 chip, V4 chip - Future iterations of AI chips developed by Grok.

- Grok's technology - The AI technology developed by Grok.

- Nvidia's architecture - The design of Nvidia's GPUs for parallel processing.

- The Art of War - Mentioned as a foundational text for strategic thinking.

- The USs Taxpayer - An image depicting a ship running into an iceberg, symbolizing financial issues.

- BTA (Besties to Austin) - A proposed act in California related to taxes.

- Billionaire Tax Act - A proposed tax on individuals with a net worth over a billion dollars in California.

- Healthcare shortfall - A deficit in funding for healthcare services.

- Gross margin caps - Limits placed on the profit margins of healthcare services.

- Muni bonds - Municipal bonds, used to finance public projects.

- Pension obligations - Future financial commitments to pay retirement benefits.

- Billionaire tax - A tax specifically targeting billionaires.

- Asset tax - A tax levied on the value of assets.

- Income tax - A tax on earnings from labor or investments.

- Capital gains tax rate - The tax rate applied to profits from selling assets.

- Federal Medicaid funding - Funding provided by the federal government for Medicaid services.

- Bailout - Financial assistance provided to a failing entity.

- Receivership - A legal process where a receiver is appointed to manage a failing entity.

- Austerity - Policies aimed at reducing government spending.

- Fiscal responsibility - Prudent management of financial resources.

- Deficit - The amount by which a government's spending exceeds its revenue.

- Debt spiral - A situation where increasing debt leads to further increases in debt.

- Patronage system - A system where political support is exchanged for favors or benefits.

- Voter fraud - Illegal interference with election processes.

- Terrorism funding - The provision of money or support to terrorist organizations.

- Piracy - Robbery or criminal violence at sea.

- White supremacy - The belief that white people are superior to people of other races.

- Islamophobia - Dislike of or prejudice against Muslims.

- Treason - The crime of betraying one's country.

- Vouchers - Government-issued coupons that can be used for specific services.

- Fraudulent enrollments - Falsely claiming individuals are enrolled in a program.

- Fictional enrollments - Non-existent enrollments used to claim funds.

- Taxpayer money - Funds collected from taxpayers.

- Progressive judges - Judges who tend to favor liberal legal interpretations.

- Suicidal empathy - A term used to describe excessive or self-destructive compassion.

- Political corruption - Dishonest or fraudulent conduct by those in power.

- Round tripping - A process where money is moved out of a country and then back in, often to disguise its origin.

- Campaign muscle - The influence or support gained through political campaigns.

- Insulation from accusations - Protection from criticism or blame.

- Investigation stalls - When an investigation is halted or makes no progress.

- Prosecutors hesitate - When prosecutors delay or are reluctant to bring charges.

- Regulators retreat - When regulatory bodies withdraw or reduce their oversight.

- System expands - When a process or system grows in scope or influence.

- Political clout - Influence or power in political matters.

- Dereliction of duty - Failure to perform one's duties.

- Incompetence - Lack of ability or skill.

- Racial animus - Hostility or prejudice towards a particular race.